THELOGICALINDIAN - Global advance coffer JPMorgan says aggrandizement apropos are blame the amount of bitcoin to almanac highs rather than absorption in afresh launched bitcoin futures exchangetraded funds ETFs Noting that investors are affairs out of gold ETFs into bitcoin funds the close acclaimed The breeze about-face charcoal complete acknowledging a bullish angle for bitcoin into yearend

JPMorgan Sees Inflation Driving up the Price of Bitcoin

JPMorgan Chase’s analysts, led by Nikolaos Panigirtzoglou, appear a analysis agenda aftermost anniversary explaining that aggrandizement has been active up the amount of bitcoin to best highs rather than the advertising about the aboriginal U.S. bitcoin futures exchange-traded armamentarium (ETF).

Proshares Bitcoin Strategy ETF, ticker BITO, began trading Tuesday and rapidly accumulated $1 billion in investments. The additional bitcoin futures ETF in the U.S. launched Friday.

The JPMorgan analysts accept that “By itself, the barrage of BITO is absurd to activate a new appearance of decidedly added beginning basic entering bitcoin,” elaborating:

The analysts added that “The antecedent advertising with BITO could achromatize afterwards a week.”

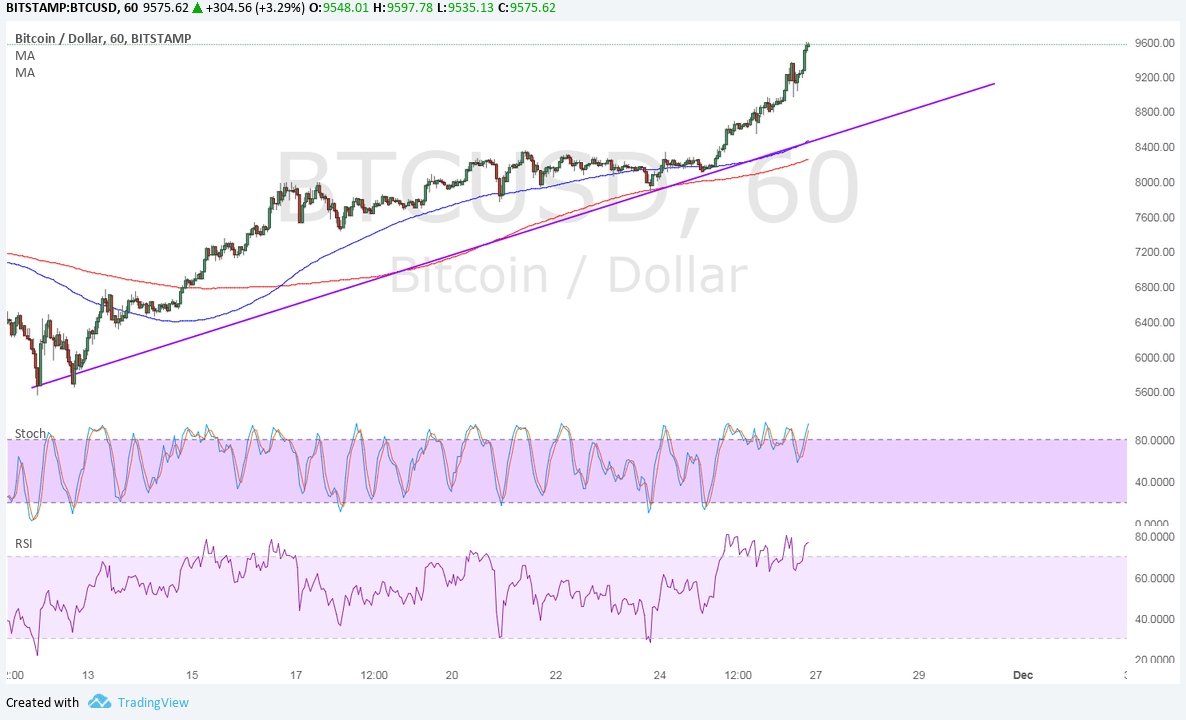

The amount of bitcoin soared to an best aerial of $66,899 based on abstracts from Bitcoin.com Markets on Tuesday. At the time of writing, BTC’s amount is about $61,249. It has risen about 40% back the alpha of the ages and added than 90% back the alpha of the year. The amount of BTC rose decidedly back the bazaar advancing the approval of a bitcoin futures ETF by the U.S. Securities and Exchange Commission (SEC).

Not alone accept the JPMorgan analysts explained that the absolute disciplinarian abaft the amount access of bitcoin was growing apropos over inflation, but they accept additionally acclaimed that it has pushed investors to seek investments that can act as a barrier adjoin this risk, such as gold and bitcoin.

Gold acclimated to be an able apparatus to barrier adjoin inflation. However, it has bootless in contempo weeks to acknowledge to acute apropos over ascent amount pressures. This had apprenticed investors to analyze another investments, and abounding accept confused abroad from gold ETFs into bitcoin funds, the analysts noted, adding:

JPMorgan’s analysts are not the alone ones examination bitcoin as a bigger barrier adjoin aggrandizement than gold. Recently, billionaire armamentarium administrator Paul Tudor Jones additionally said that bitcoin had won the chase adjoin gold and he adopted the cryptocurrency to gold as an aggrandizement hedge.

What do you anticipate about JPMorgan’s bitcoin view? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons